Accountancy Blog

Check out our blogs and articles.

Introducing HMRC’s New Self-Serve Time to Pay for VAT

In a recent development, HM Revenue & Customs (HMRC) has introduced a convenient online platform for certain businesses to set

The Benefits of Outsourcing Your Partnership Accounting

As a partnership, you have a lot on your plate. From managing daily operations to cultivating client relationships, there's never

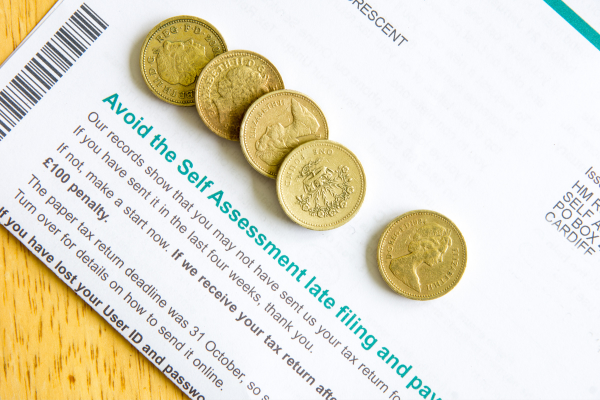

Beat the Self Assessment Tax Deadline Rush

Early planning with your personal tax accountant to get ahead next year. HMRC reported that more than 12.2 million self-assessments

Why Working with a Local Accountant is Crucial for Construction

If you're a construction business in Kent, you know how important it is to have an accountant who understands the

The importance of Bookkeeping for small businesses

Staying on top of your finances and maintaining meticulous records is essential to the success of any owner-managed business. Get

Get Your Self-Assessments Right with an Accountant

As the self-assessments deadline approaches, many taxpayers are rushing to get their tax returns submitted on time. While filing a

How long should you keep your Limited Company records?

Maintaining accurate and up-to-date records is a crucial part of running a Limited Company. But how long should you keep

What’s the Difference Between Financial Management and Bookkeeping?

As a small business owner, you wear a lot of hats. You're responsible for everything from marketing to looking after

Why Outsourcing Your Payroll to an Accountant is a Smart

As a business owner or manager, you have enough on your plate without having to worry about payroll. After all,