As a contractor or limited company, you may be using a personal vehicle for business journeys during the week (whether for convenience or necessity), so you might be wondering if you can claim tax relief on mileage expenses, what the mileage allowance is, and what criteria you need to meet to claim. This blog will answer all of those questions for you.

Contents

What are the Mileage Allowance rates 2023/2024?

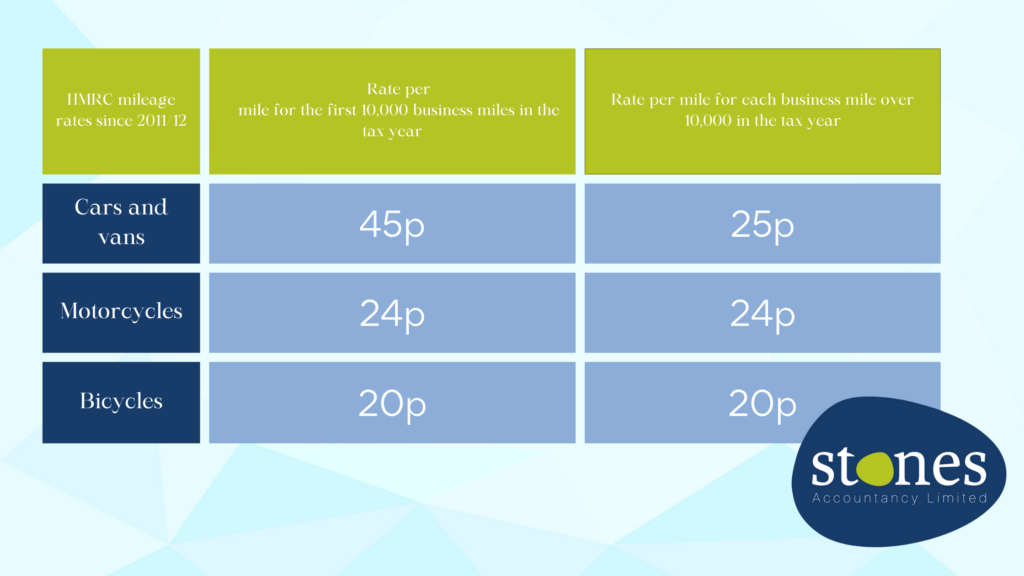

HM Revenue and Customs (HMRC) has set UK mileage rates, which you can claim for if you use a private car, van, bike, or motorcycle for business journeys.

The Mileage allowance rates for this year are currently 45p per mile for the first 10,000 miles and 25p for each additional mile for a car or van.

For a motorcycle, the rate is less at 24p per mile.

For bicycles, you can claim 20p per mile.

These rates are relatively generous, as they’re designed to compensate for private vehicle running costs. The company mileage claim can be treated as a business expense, which means both company directors and employees can claim back mileage for business journeys.

Do I need to report Mileage Allowance payments to HMRC?

These are often designated as ‘travel expenses’ and in terms of the reimbursement you can claim the UK mileage allowance as a contractor from your limited company. If, as an employer, you decide to reimburse your employees more than the HMRC approved mileage rates, you will need to report this to HMRC, however, you do not need to if you choose to pay your employees less than the Approved Mileage Allowance Payments rates (AMAP).

The difference between the lower amount paid by the employer and the AMAP rates can be claimed through a Self-Assessment Tax Return at the end of the year.

To be clear, is this not the same as using a company car for travel, where your business claim would be an ‘Advisory Fuel Rate’. These rates are reviewed four times a year, so as to be in line with current costs of fuel and cover company cars and private travel of employees. To know which of these schemes you qualify for and how to claim, contact us here.

Tracking Employee Mileage Allowances

Cloud-based accounting and paper-free accounting can allow you to track how many miles you qualify to claim, and for how much throughout the year. Some of these systems will even calculate the miles between 2 points using GPS, removing the need to track this manually each time you use your vehicle.

In Summary:

- Private Cars, Vans, Bikes, and Motorcycles qualify for HMRC’s Mileage Rate if used for business travel

- The mileage rate for the first 10,000 miles (within the same tax year) is 45p for cars and vans.

- The mileage rate for any mile after the first 10,000 drops to 25p.

- You can claim as a contractor or employee, this is not specific to directors.

If you’d like to know how we can help use one of our recommended processes or you’d like to make a claim, we can support you, get in touch with the team to find out how.